When this year’s festive season arrived, it wasn’t just the quick commerce and ecommerce carts or gold marketplaces that saw a rush. A new kind of festive frenzy unfolded inside India’s apartments — on quick services apps.

Platforms offering instant home services — on-demand cleaners, cooks, and domestic help available within 10–15 minutes — recorded their sharpest surge yet in October.

Industry sources say the segment collectively clocked around 8 lakh transactions this month driven by Diwali-led cleaning sprees, visiting guests, and absentee regular maids.

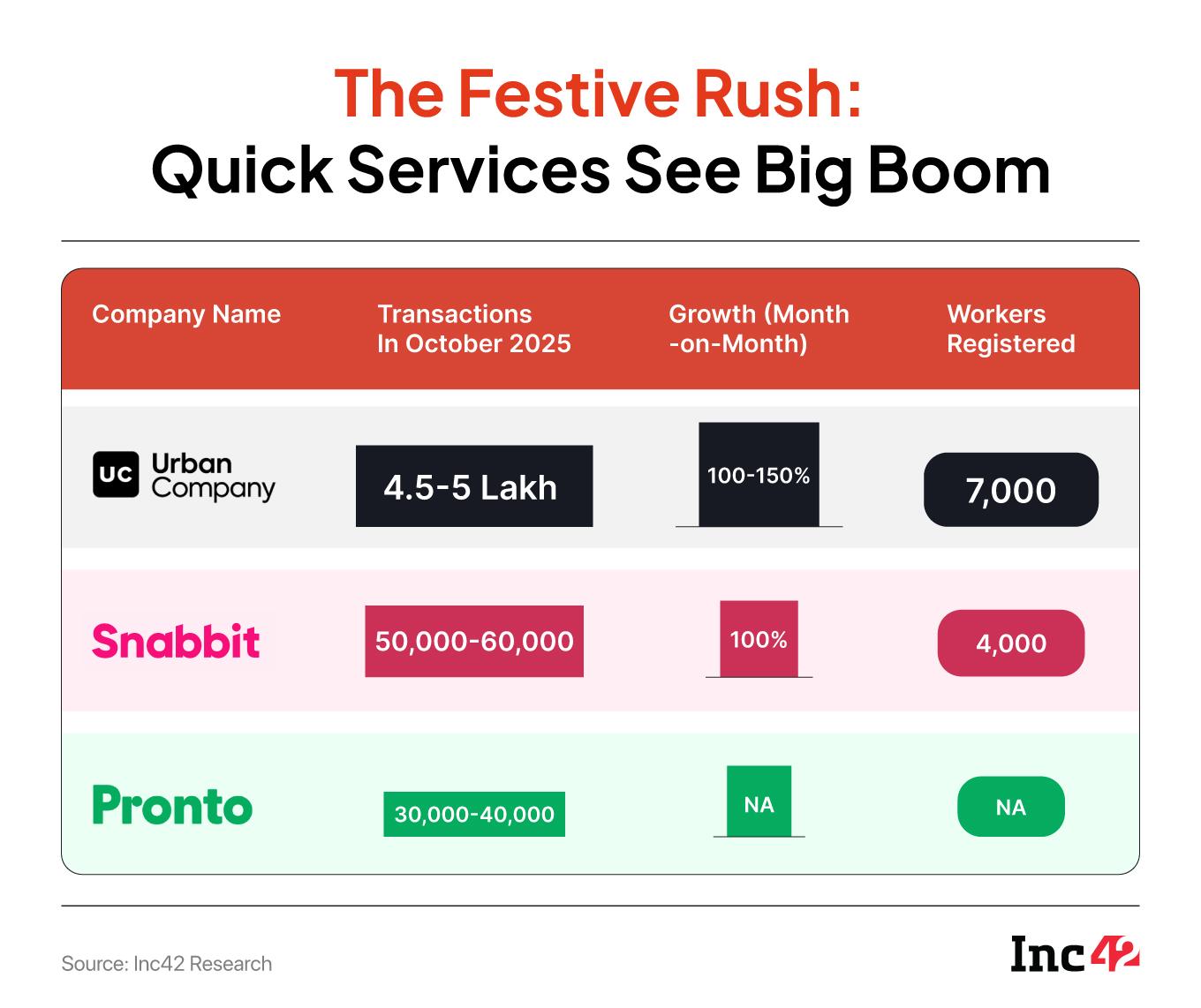

Leading the pack was Urban Company, which logged about 4.5 lakh transactions across four cities — Mumbai, Delhi NCR, Bengaluru, and Hyderabad.

That translates to roughly 65% of the platform-based domestic help market, according to insiders who have seen Urban Company’s internal data but are not authorised to speak to the media.

Similarly, Lightspeed-backed Snabbit, which pioneered the 15-minute professional services model, saw a big surge, handling 40,000-50,000 bookings. Pronto, another leading player in the space, clocked 30,000 orders during the festive season, sources claimed.

Snabbit founder and CEO Aayush Aggarwal told Inc42, “High-frequency services is a $45 Bn industry with less than 2% digital penetration, growing at double-digit CAGR. We are looking at the biggest tech revolution in consumer technology this decade. This is paving the way for urban India’s last major offline habit,” Agarwal told Inc42.

Together, these quick services platforms have turned India’s informal domestic help economy into a new, tech-enabled vertical with the players competing on the metrics like discounts, professionals onboarding, order volumes/ values and growth strategies.

Festive Momentum For Urban CompanyGiven their relative novelty in the Indian startup ecosystem, this was the first major peak season test of the quick services segment. So the festive momentum comes at a pivotal time.

Analysts attribute the spike to seasonal factors such as the absenteeism surge during festivals, with urban families facing higher disruptions, prompting a shift to app-based, verified professionals who are at their doorsteps in 10-15 minutes.

Urban Company, Snabbit, Pronto among others are capitalising on this by formalising the informal gig economy, offering shift-based help with tech-enabled matching in metro cities.

However, one big challenge is that the average order value of the segment remained at a modest INR 180-200 (exclusive of discounts), sources claimed, which means this is a volume game. And therefore the focus of most of these platforms is on high-frequency usage.

Urban Company began testing the Insta Help service in Mumbai in early 2025. It was seen as a natural extension to build a top of the funnel revenue driver and unlocking higher usage frequency for its 6 Mn+ users.

While the demand for Urban Company’s existing services which includes beauty, salon services, carpentry, plumbing and other house repairs has been robust, Insta Help is expected to be the next growth driver, according to Urban Company CEO Abhiraj Singh Bahl’s earlier statements.

“Given its frequency and relevance to Indian households, instant services could become a strong strategic driver,” Bhal had earlier said.

Sources within Urban Company mentioned that Insta Help orders have doubled month-on-month despite the platform not offering heavy discounts. The recently-listed company is said to have onboarded 6,000-7,000 professionals so far under this vertical.

Yet, challenges persist. High onboarding costs and seasonal worker migration mean companies have to constantly look to increase the supply of workers. Plus the growing competition means there will be a fight for professionals on the ground.

Competitive Heat: Pronto, Snabbit Join The RaceWhile Urban Company leads, the race is tightening in 4-5 key metros, where competition is almost neck-to-neck. Snabbit has emerged as a close second, logging 40,000-50,000 monthly transactions and claiming around 30% share in select pockets, per industry estimates.

Founded in 2024 by former Zepto exec Aayush Agarwal, Snabbit recently shifted its base to Bengaluru and has seen 100% volume jump in October, as per sources.

The startup has raised $19 Mn from Lightspeed, Nexus Venture Partners and Elevation Capital. Agarwal said the company plans to double its workforce by FY26 amid 20-25% week-on-week growth.

Founded by Anjali Sardana, Pronto, the third player in this space has also seen a surge. This comes after a $11 Mn Series A round, led by General Catalyst and Glade Brook Capital. The company is said to be targeting 10,000 workers for its instant services model.

In a recent LinkedIn post marking six months since launch, Sardana reflected on the surge: “Six months ago, we were five people launching Pronto from Sector 56, Gurgaon. We camped at a factory for 48 hours to get uniforms ready on time… Today, we’re a team of 100+ serving thousands of households daily.”

The online maid services industry also has other organised players like BookmyBai, Broomes, Helper4U however a majority of these players do not work on the instant service model and their AOVs are significantly higher. Many of these also function as marketplaces with no set charges or rates.

A fund manager at an early stage firm, which has backed one such platform, claims the total addressable market for instant services is around 100 Mn households in urban India right now. Having a strong supply base is essential during the festive season because this is when consumers are more likely to prove the high-frequency usage thesis.

“Festive season is when consumers try the service,” the VC added.

The phenomenon mirrors early food delivery and quick commerce models, where seasonal momentum drove habit formation.

“The difference is that this is a trust service, not a logistics one. Once people experience trained domestic help, they’re less likely to go back to informal arrangements,” the investor added.

Beyond the Festive GlowDespite the October high, unit economic sustainability questions loom large over the instant services segment. Currently, both Snabbit and Pronto are basking in VC funding and are looking at market expansion, discounts-led customer acquisition and onboarding of workers on the basis of high pay.

But once the model matures, there could be problems such as low worker pay, bad quality of services and more. Plus, heavy investments for worker welfare—insurance, certifications, wage guarantees— will likely dent the margins in this growth phase.

The low AOV of INR 180–INR 200, despite robust order volume growth leave little margins for the platforms after cutting out the logistics costs and worker pay. This is why this segment is heavily reliant on volumes, and unless that is achieved, the path to profitability can be a challenge.

Industry sources we spoke to pointed out that like quick commerce, quick service players are focussing on category creation and will tighten unit economics only after reaching a scale.

The adoption of instant services outside the festive season will be the key factor.

There is a regulatory overhang in the sector too both at the central and state levels with specific guidelinescalling for social security, minimum guarantee wages, implementation of formal contracts and worker safety that adds to the compliance burden for the platforms.

Besides that, the platforms are also under scrutiny for the promotion and marketing of these services especially with respect to being insensitive to this class of professionals, as well as low pay.

Urban Company claims that the workforce under ‘Insta Help’ can potentially earn INR 20,000-25,000 per month. Workers also receive health insurance and on-job life and accidental coverage. But this model has not been proven for too long at this point in time.

Pronto follows a similar playbook, positioning itself as a “worker-first platform” with predictable income.

CEO Anjali Sardana earlier told Inc42that Pronto operates with a “full stack” model for its service professionals in order to maintain quality as the platform expands.

To source the talent, the startup primarily relies on referrals. Its employment model is also designed to attract and retain quality professional

However, industry-wide concerns remain around working hours, algorithmic scheduling, and occupational health.

The Race to Sustain MomentumNow that the festive season dust has more or less settled, the question is whether these platforms can sustain growth without discounts.

For Urban Company, the Insta Help vertical is not just a seasonal cash-in. High frequency usage is the holy grail for such platforms.

Its more intense cleaning and salon services are high margin services but low frequency. In contrast, quick domestic services have daily or weekly engagement, driving more retention, and increasing the company’s ability to upsell and crosssell.

That explains why Urban Company and others are willing to operate at low margins for now.

As instant services move from novelty to necessity, the next phase of competition will be about integration or bundling of services which caters to multiple home needs in urban households like cleaning, cooking, errands, child support. We are likely to see evolved subscription models, but training and verifying workers will also be essential.

While the quick services segment was born out of necessity and the need to organise, as it matures, there are many considerations.

Will gig workers get a fair share of this value or will these platforms suffer the same pitfalls as those in food delivery and ride-hailing? Will consumers continue to embrace quick services over long-term relationships with their domestic help?

Instant help and quick services need to show that their models are relevant even outside the Diwali rush.

[Edited By Nikhil Subramaniam]

The post Post-Diwali Glow: Urban Company, Snabbit Cash In On Festive Frenzy For Quick Services appeared first on Inc42 Media.

You may also like

Mamata govt has not learnt any lesson from RG Kar incident: BJP's Keya Ghosh after 15-year-old girl's alleged molestation at Kolkata's SSKM Hospital

Sarkari Naukri: Recruitment for 938 posts in Maharashtra, apply by October 27 at mpsc.gov.in..

Crucial day for Kerala's Left parties over PM SHRI row

Pakistani drone drops bags containing over 5 kgs heroin along IB in Jammu

Baloch activists protest in South Korea, highlighting growing brutality by Pakistani forces