Here’s a curious thought for you this Sunday: Whenever a startup acquires a legacy firm or a bigger player, it has usually not worked out.

Take the billion-dollar deal between BYJU’S and coaching giant Aakash, which has more or less failed in light of the troubles for BYJU’s. Or ride-hailing startup Ola, which splurged nearly $200 Mn to acquire FoodPanda and enter food delivery, before realising it was not just about acquiring a company.

There are exceptions of course, but more of than not, it has not turned out to be a good match.

PharmEasy took it a notch higher to become the first startup to acquire a publicly listed company — Thyrocare — back in June 2021 for INR 4,440 Cr (around $600 Mn at the time), a 9X revenue multiple.

Thyrocare was profitable all along and PharmEasy was flush with over $1 Bn funds raised. What PharmEasy did not have was profits, and it was hoped that Thyrocare would be the magic bullet to change this. Unfortunately for PharmEasy, four years later, profits are still elusive.

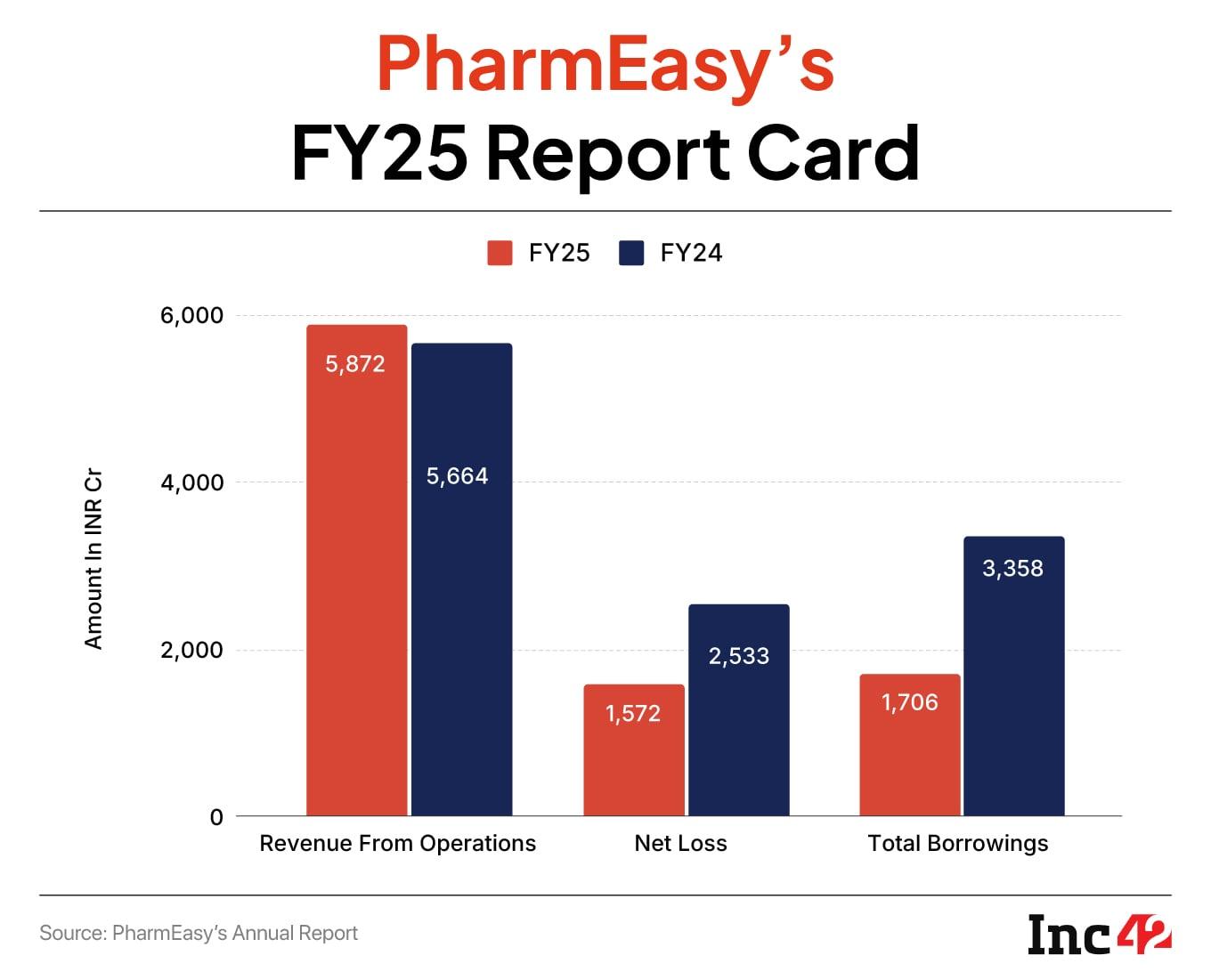

In fact, the company has reported a loss of INR 1,517 Cr in FY25, which is 40% lower than FY24, but with its top line remaining almost flat, this was not a major needle-moving improvement. Even so, that’s an improvement on the 15% revenue decline in FY24.

So time to dive deeper into the B2B and B2C pharma company’s woes, but after a look at the top stories from our newsroom this week:

- PhysicsWallah’s IPO Litmus Test: Earlier this week, the edtech major filed its updated DRHP to raise INR 3,820 Cr via its IPO. Amid the dilapidated state of Indian edtech, the listing could be a breath of fresh air. But is PW’s touted listing more smoke than fire?

- The Q-Commerce Ad Goldmine: The quick commerce arena has turned into a marketing battleground. What started as a convenience play has evolved into India’s newest advertising goldmine that is threatening Google and Meta.

- FirstClub’s Premium Q-Comm Sizzle: Unlike other quick commerce players, the startup sells “high-quality” everyday essentials and lifestyle products at affordable prices. Can its premium-focussed model compete with giants like Zepto, Blinkit and Instamart?

Siidharth Shah and his close friends and cofounders Dharmil Sheth, Dhaval Shah, Harsh Parekh, and Hardik Dedhia wanted to build a holistic health and wellness platform that could source, prescribe and sell medicines, through online and offline touchpoints. The startup acquired its way to get halfway there before losing steam.

It acquired Aknamed in 2018, Thyrocare and B2C pharmacy Medlife in 2021 to enter verticals such as pharma supply chain, health consultations, diagnostics and testing.

Along the way, the company also borrowed heavily when the zero interest rate fiscal policy was in place during the pandemic. While raising these funds was easy, paying it back became costlier and costlier for PharmEasy.

Any growth at this stage was a result of cashburn, with the exception of Thyrocare. Once valued at $5 Bn, PharmEasy is struggling to turn cash flow positive five years after that high-profile acquisition.

Most of its struggles have come as a result of the $300 Mn (INR 2,220 Cr) loan from Goldman Sachs which eventually was charged an annual interest rate of 17-18%.

Growth was hard at this point and other epharmacies pulled ahead of PharmEasy. 1MG got Tata’s backing, NetMeds got the Reliance platform to grow, but PharmEasy simply could not move on from the downturn after 2022.

New Leadership Amid The ChaosAnother connection to BYJU’S is Manipal Group’s chairman Ranjan Pai who stepped in as a white knight for BYJU’S and Aakash and did the same with PharmEasy. He participated in PhamEasy’s rights issue as an external investor investing INR 1,300 Cr in 2023.

The Manipal Group Chairman through his family investment office has since put in INR 800 Cr in 2024 thus raising his stake to double digit in API Holdings which saw its valuation erode by 90%.

In August 2025, Siddharth Shah stepped down as the chief executive officer in August 2025. The cofounder will remain the vice chairman at PharmEasy’s parent entity API Holdings, while Thyrocare managing director and chief executive Rahul Guha took over at the helm at PharmEasy.

Today, PharmEasyis still cash flow negative, has various assets on its books whose values have been drastically impaired dragging its losses further and sold off some of its subsidiary companies at reduced value, according to Inc42’s analysis of API Holdings’ FY25 Annual Report.

With Shah’s exit from CEO role, API Holdings effectively is now controlled by Ranjan Pai’sFamily Office, Prosus, TPG, Temasek and other investors. While the new leadership could steer PharmEasy’s sinking ship towards profitable shores, it first needs to come out of the hole it has dug itself over the years.

The Debt BurdenAt the heart of PharmEasy’s troubles lies its mounting debt burden. In 2022, the company borrowed $300 million (INR 2,220 crore) from Goldman Sachs through non-convertible debentures (NCDs) at a steep 17-18% interest rate.

This loan was meant to bridge liquidity gaps post the failed IPO attempt in 2021, when PharmEasy aimed to raise INR 6,250 crore but eventually withdrew due to market volatility.

A key covenant required PharmEasy to raise at least INR 1,000 crore ($120 million) in fresh equity within the first year after the amount was disbursed i.e. August 2023.

There were other stipulations including the fact that PharmEasy had to raise fresh equity capital as well and maintain a healthy debt to equity ratio. But PharmEasy failed to meet these terms.

According to API Holding’s FY25 report, the company had paid several tranches to Goldman Sachs and medical supplies firm Evox to service this loan — totalling INR 1,772 Cr and INR 250 Cr respectively.

PharmEasy’s net cash flow remains negative and total exposure to borrowings as of FY25 was INR 1,700 Cr. At its peak, this number was INR 3,358 Cr, the report shows.

The company has further incurred losses on its investments by selling off a few of its subsidiary companies at a loss which has been recorded as “exceptional loss” on books in FY25 to the tune of INR 44.5 Cr, as per its annual report.

Amidst the financial woes, PharmEasy’s 90% valuation erosion from its $5.6 Bn peak to $456 Mn during its rights issue and subsequent fundraises in 2024, could also be an overhang on its IPO pricing and valuation prospects.

Revenue Concentration: The B2B DependencyWhat will save PharmEasy? Will it be the B2B business or the consumer brand itself?

While PharmEasy’s journey may have begun as a B2C online pharma marketplace, its revenue model has increasingly tilted toward B2B operations. But in line with the original vision, both parts of the business are important.

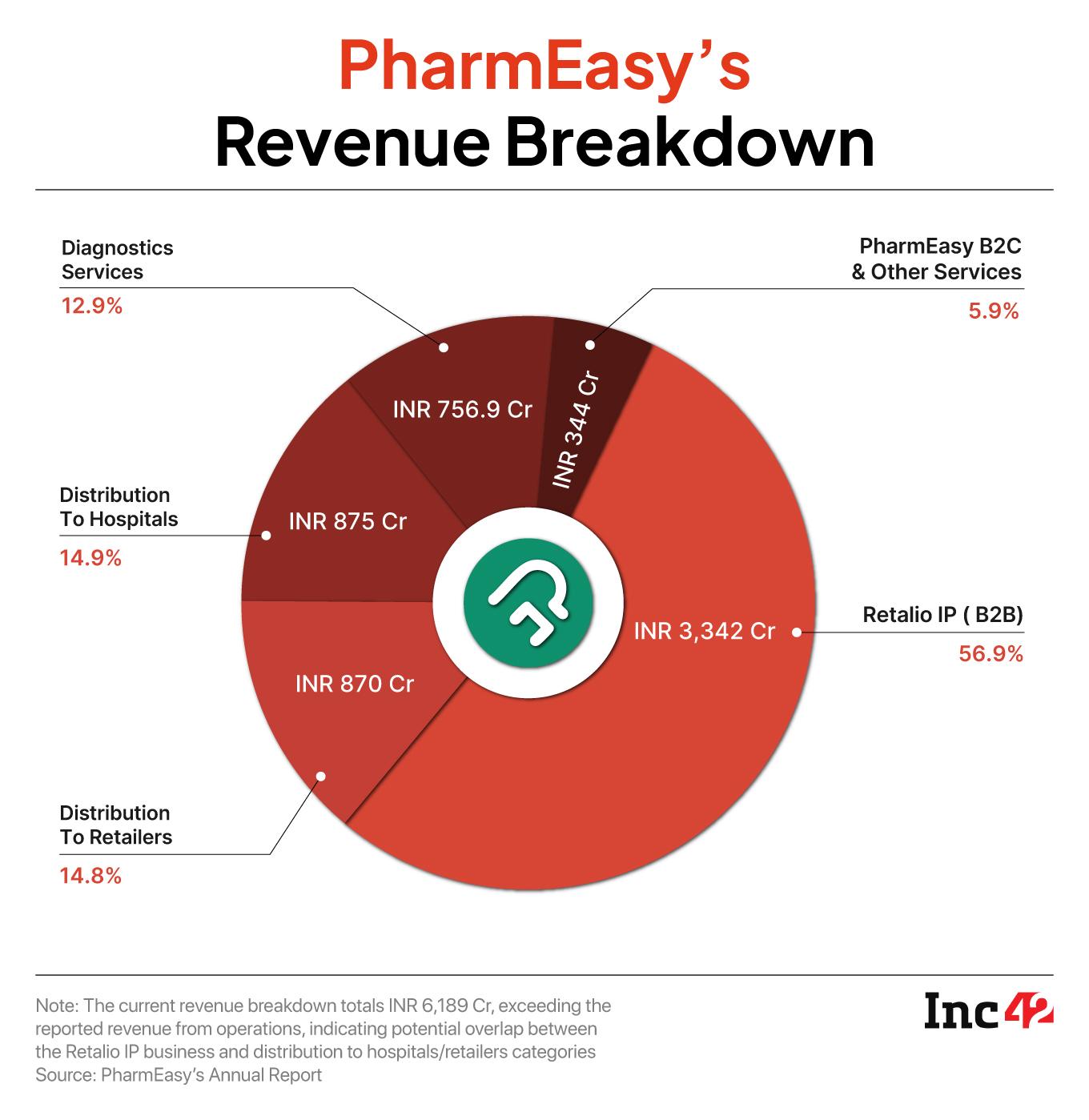

In FY25, a major chunk or 87% of PharmEasy’s operating revenue of INR 5,097.5 Cr came from pharmaceutical and cosmetic sales. B2B sales — procurement of pharmaceutical, OTC, surgical, consumables from pharmaceutical companies and selling to local chemists and health institutions — through Retailio generated INR 3,343 Cr in revenue in FY25, accounting for 56.9% of total revenue.

On the brighter side, average revenue per retailer rose from INR 48,000 in March 2024 to INR 53,000 in March 2025, signaling improved efficiency.

Diagnostics, via Thyrocare, contributed INR 757 Cr (12.9%) but notably, PharmEasy’s once core B2C marketplace and “other services” added just INR 344 Cr (5.9% of overall revenue) to the company coffers.

So while the B2B model is sustaining PharmEasy, the brand behind the B2C platform has failed to shine.

IPO On The Horizon?As PharmEasy eyes a probable IPO in FY26 according to media reports, its path remains fraught with the same perils that have continued to dog Indian startups.

Any attempt to relaunch the IPO ambitions after giving them up in 2021 would need to be accompanied by measurable improvements in the bottom line and a predictable growth path.

Once again, Thyrocare will be seen as a saviour for PharmEasy from the point of view of profits, given the relatively thin margins in B2B pharma and long receivables cycles. Somehow PharmEasy’s dependency on Thyrocare’s cashflow has not changed in the past four years.

If anything, PharmEasy’s loss is the gain of new players like Swiggy-owned Instamart, Zepto and Blinkit, as we covered a few weeks ago.

PharmEasy’s saga once again underscores the perils of aggressive acquisitions without serious long-term planning.

Currently, PharmEasy’s unlisted shares are being traded at INR 7-12 per share, which shows the state of the company in the grey market. Its valuation has plummeted significantly to $500-600 Mn. With most marquee investors looking to shift off the company, and the exit of all the cofounders, the $600 Mn question is will the company script a turnaround, or join other cautionary tales from the Indian startup ecosystem?

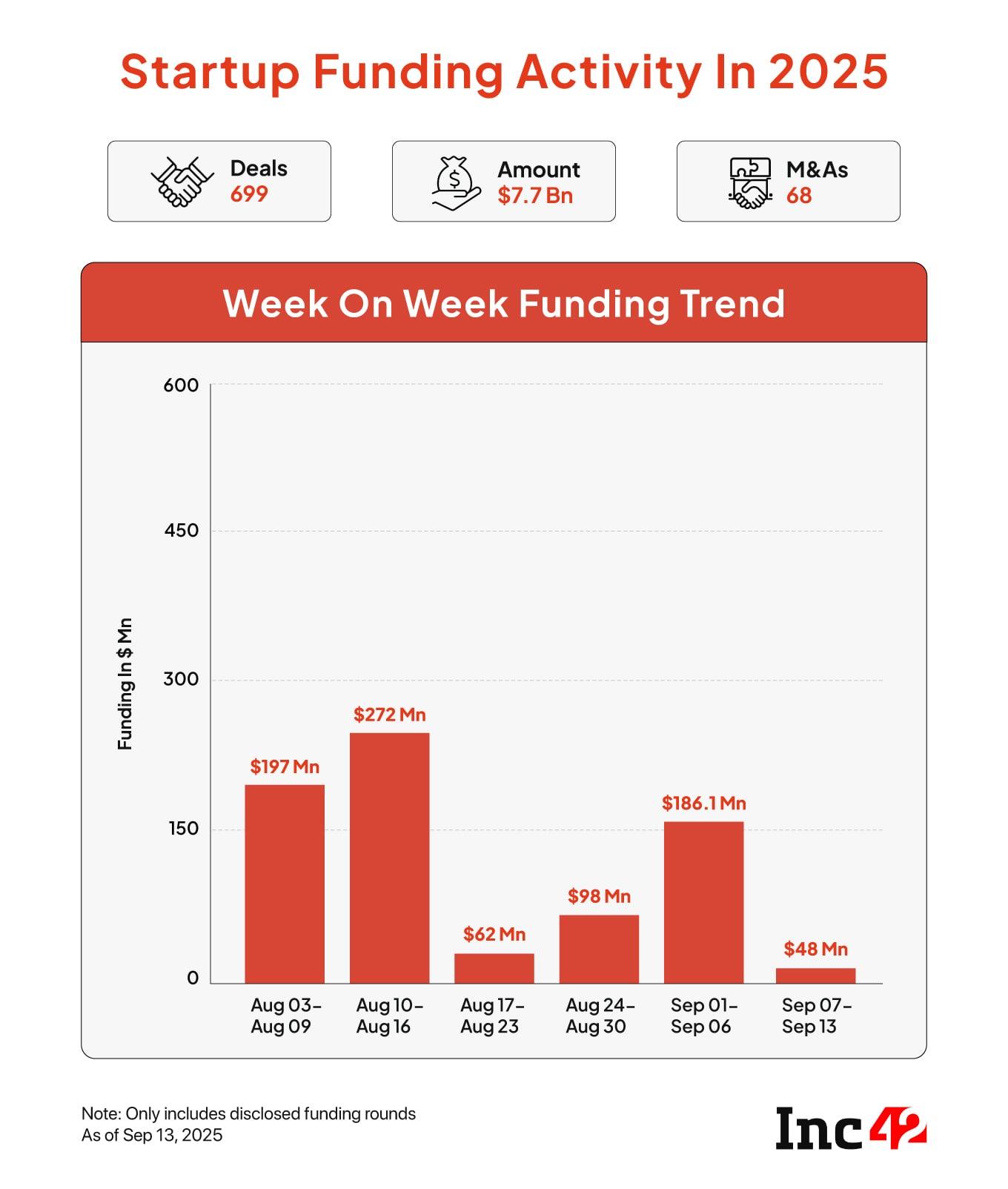

Sunday Roundup: Startup Funding, Deals & More- Funding Drops: Indian startups raised a mere $47.8 Mn across 18 funding deals between September 8-13. This marked a 74% drop from the previous week

- Early Diwali At PhonePe: The fintech giant has initiated an ESOP buyback scheme worth up to INR 800 Cr. The move is expected to benefit 1,000 out of the company’s 12,000 employees. This comes as PhonePe is looking to raise up to $1.5 Bn via its IPO

- Tata 1mg’s User Retention Model: The epharmacy’s marketing stack is built on acquiring new users, keeping them engaged and ensuring they return. Going forward, 1mg is now reshaping its marketing engine by integrating AI and focussing on privacy.

- Games24x7 Axes 500 Jobs: Following the Centre’s ban on online real money gaming, the unicorn now plans to lay off nearly 70% of its workforce. This comes months after the gaming giant fired 180 employees in May, fearing a revenue hit from a GST clarification

- Flipkart’s Revenue Landmark: Flipkart’s marketplace business crossed the INR 20,000 Cr revenue mark in FY25, reaching a new high as income from operations rose 14.4% from INR 17,907 Cr in FY24

The post PharmEasy’s Uneasy State appeared first on Inc42 Media.

You may also like

Rebel Labour MPs plot to oust Keir Starmer as secret plan exposed

He had an astrophysics degree and a finance career at 23, but walked away to invest in a frozen yogurt franchise. Now, 30, he is making 8-figures a year

John Terry shows his true colours by explaining why he doesn't want Chelsea to win title

Asia Cup: Five exciting match-ups to watch out for in India vs Pakistan showdown

Arsenal injury list compared to title rivals after Martin Odegaard and William Saliba updates