The stage is set for Lenskart’s D-Street debut. Within a span of two weeks, the omnichannel eyewear giant received SEBI’s nod, filed its RHP and set the price band for its IPO. As Lenskart’s public issue opens on October 31, here’s how its IPO stacks up.

Eye On The Prize: The unicorn has set a price band of INR 382 to INR 402 for its upcoming IPO, valuing the eyewear retailer at a nifty INR 69,726 Cr.

Overall, its public issue will comprise a fresh issue of shares worth INR 2,150 Cr, as well as an OFS component of 12.76 Cr shares. The latter is likely worth INR 5,000 Cr at the upper end of its price band. Backers, including SoftBank, Premji Invest, and Temasek, and cofounders will partially exit through the IPO.

In its RHP, the company also revealed its Q1 FY26 performance:

- Lenskart churned a profit of INR 61.2 Cr against a loss of INR 11 Cr in Q1 FY25

- Operating revenue zoomed 25% YoY to INR 1,894.5 Cr

- Total expenses surged 17.7% YoY to INR 1,836.6 Cr

Market In Its Grip: Lenskart is coming to the markets with a proven playbook. Its omnichannel empire, spanning 2,723 stores globally, and a strong D2C presence have created a defensible moat that online-only rivals cannot breach.

The Achilles’ Heel: Lenskart is seeking an INR 69K Cr+ valuation, which translates to a sky-high price-to-earnings ratio of 228.41. Investors are being courted to pay a significant premium for a company that has recently turned profitable. Furthermore, the public issue is dominated by an OFS, meaning a significant portion of the IPO will be cashed in by early backers.

Despite the odds, Lenskart looks unfazed as it gears up for its INR 7,000 Cr+ OFS-heavy IPO.

From The Editor’s Desk- Kabeer Biswas is stepping down from his role as vice president (VP) of Flipkart’s quick commerce arm, Minutes, less than a year after joining. Company veteran and VP Kunal Gupta will succeed Biswas.

- Biswas joined Flipkart earlier this year, following the shutdown of his hyperlocal delivery startup, Dunzo. Under his leadership, Minutes established 400 dark stores and expanded operations to 17 cities.

- The departure comes as Flipkart navigates a fiercely competitive quick commerce market, high cash burn and mounting losses. Its impending IPO has also added pressure to turn profitable and expand its footprint.

Stanza Makes Room For Big Bucks

Stanza Makes Room For Big Bucks - The managed accommodation provider is raising INR 282.8 Cr in a fresh round led by early backer Accel, which is investing INR 222.78 Cr, and Motilal Oswal (INR 60 Cr infusion).

- Founded in 2017, Stanza Living offers managed accommodations for students and working professionals across 15 Indian cities. The startup claims to manage over 50,000 beds, providing bundled services like food, WiFi, and security.

- The investment signals continued investor faith in India’s managed accommodation sector, which remains heavily fragmented and unorganised.

- Paytm now allows NRIs from 12 countries to make UPI transactions using their international mobile numbers. Currently in beta mode, the feature is available for users in countries including the US, UK, UAE, Canada, and others.

- The new offering is part of the fintech major’s long-term plan to crack the international markets to create alternate streams of revenue, acquire a high-value user segment and expand its footprint.

- While the feature doesn’t tap into the lucrative remittance segment, it targets the next crucial step – how that money is spent in India. With this, Paytm is digitising the last-mile spending for a diaspora that sends billions home.

- The bootstrapped broking major has announced it will allow users to invest in US stocks, starting next quarter. The long-awaited feature will be offered through GIFT City, which simplifies the regulatory hurdles that previously delayed the launch.

- Zerodha first considered offering US stock access in 2020 but paused the initiative due to the complexities of remittance under the RBI’s liberalised remittance scheme and disruptions from the pandemic.

- This diversification is a strategic necessity for Zerodha, which is facing its first revenue and profit decline in over a decade due to SEBI’s clampdown on F&O trading, slowing investor participation and higher BSDA limits.

- In a landmark judgment, the Madras HC has declared that cryptocurrency qualifies as ‘property’ under Indian law, capable of being owned, transferred, and held in trust.

- The case was initiated by an investor after WazirX froze her 3,532.30 XRP tokens as part of a “socialisation of losses” scheme to cover the $235 Mn hack.

- The ruling provides unprecedented legal clarity for the Indian crypto ecosystem, granting digital asset holders clear ownership rights and legal recourse against fraud or exchange failures.

India generates around 9.3 metric tonnes of plastic waste annually, making it one of the world’s largest plastic polluters. A major portion of this waste is multi-layered plastic (MLP), which is nearly impossible to recycle.

Less than 1% of MLP is recycled, and informal waste pickers handling this plastic face severe health risks and lack formal employment. Despite regulations, plastic waste continues to accumulate, creating an urgent environmental and social challenge.

Turning Waste Into Worth: Pune-based WITHOUT, founded by Anish Malpani in 2020, addresses both the recycling and social employment gap. The company collects MLP and utilises its patented technology to manufacture products like eyewear, buttons, tiles, and signage.

Empowering Ragpickers: WITHOUT works with informal waste pickers, formalising their employment, increasing incomes 2X–3X, and providing training and stock options. The startup has a pre-commercial plant capable of processing 5 tonnes of complex waste per month, with plans for a fully commercial facility next year.

Innovation Meets Impact: By turning unrecyclable waste into high-quality products and formalising informal employment, WITHOUT not only tackles India’s plastic crisis but also creates a scalable, socially impactful business. Its technology has potential beyond D2C products, with applications in large-scale manufacturing.

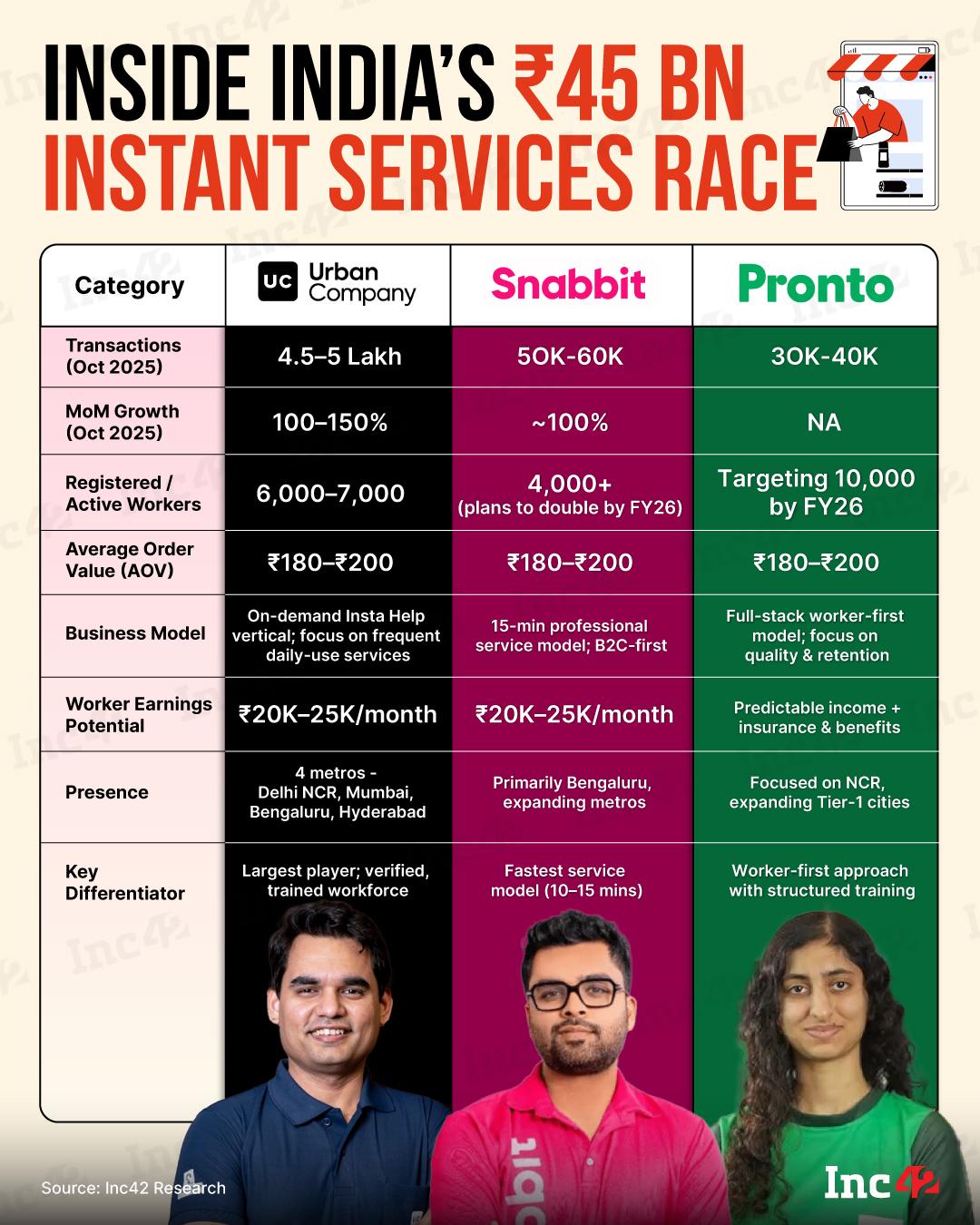

This Diwali, the real hustle wasn’t just in quick commerce carts, it was inside India’s homes. A new kind of festive frenzy took over, driven by instant home services apps offering cleaners, cooks, and domestic help within 10–15 minutes.

The post Lenskart’s IPO Next, Kabeer Biswas Quits Flipkart & More appeared first on Inc42 Media.

You may also like

'Attempt to impose Nizami language': BJP lashes out at name in Urdu on Chhatrapati Sambhajinagar station boards; AIMIM hits back

Record breaking sale: Young Falcon sells for USD $36,265 at Saudi Falcons Club Auction 2025

Dual voter ID row: EC notice to Prashant Kishor over name in Bihar, Bengal rolls; seeks reply in 3 days

Bengal assault case: Daughter of arrested BJP leader files counter complaint claiming molestation

BPCL signs pacts with OIL, NRL, FACT