The Employees’ Provident Fund Organisation ( EPFO) will seek its board approval for redeeming investments in the CPSE and Bharat 22 exchange traded funds ( ETFs) in the ongoing fiscal 2025-26, but not in other ETF schemes as it seeks to extend their holding period to five years from four.

The proposal, if approved, will fetch an expected capital gain of ₹17,237.27 crore, which the retirement fund body will credit to the interest account for distribution among EPF members as annual interest later this year.

The organisation will also seek board approval for EPFO 3.0, a project that is expected to completely overhaul its IT infrastructure and related architecture.

This advanced system is expected to cater to the social security benefits for gig and platform workers, as well as help handle higher workload as the EPFO adds more subscribers, either through the Employment-Linked Incentive Scheme or under the Code on Social Security, 2020, once it is notified.

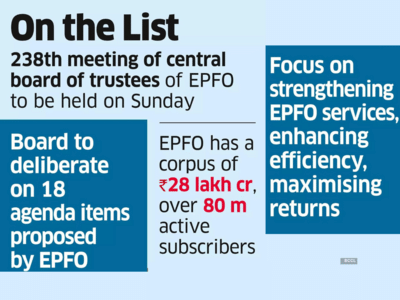

The EPFO’s central board of trustees (CBT), which is scheduled to meet on Sunday under the chairmanship of labour and employment minister Mansukh Mandaviya, is expected to deliberate on 18 agenda items. ET has seen a copy of the agenda circulated among the CBT members.

CBT is the highest decision-making body of the EPFO and has representatives from both employers and employees as well as from state governments and the central government.

The pattern of investment, notified by the finance ministry, prescribes 5-15% of fresh accretions to be invested in equities and related investments under Category (iv). Following the approval from its board in 2017, the EPFO is investing up to 15% of the incremental investments in ETFs under Category iv (c) and iv (d).

Investments under Category iv (c) are done on a daily basis. Investments under Category iv (d), replicating the indices BSE Bharat 22 and the NSE Nifty CPSE, were done in multiple tranches, during the years 2017, 2018, 2019 and 2020.

The EPFO manages more than 300 million member accounts and has a corpus of ₹28 lakh crore.

The proposal, if approved, will fetch an expected capital gain of ₹17,237.27 crore, which the retirement fund body will credit to the interest account for distribution among EPF members as annual interest later this year.

The organisation will also seek board approval for EPFO 3.0, a project that is expected to completely overhaul its IT infrastructure and related architecture.

This advanced system is expected to cater to the social security benefits for gig and platform workers, as well as help handle higher workload as the EPFO adds more subscribers, either through the Employment-Linked Incentive Scheme or under the Code on Social Security, 2020, once it is notified.

The EPFO’s central board of trustees (CBT), which is scheduled to meet on Sunday under the chairmanship of labour and employment minister Mansukh Mandaviya, is expected to deliberate on 18 agenda items. ET has seen a copy of the agenda circulated among the CBT members.

CBT is the highest decision-making body of the EPFO and has representatives from both employers and employees as well as from state governments and the central government.

The pattern of investment, notified by the finance ministry, prescribes 5-15% of fresh accretions to be invested in equities and related investments under Category (iv). Following the approval from its board in 2017, the EPFO is investing up to 15% of the incremental investments in ETFs under Category iv (c) and iv (d).

Investments under Category iv (c) are done on a daily basis. Investments under Category iv (d), replicating the indices BSE Bharat 22 and the NSE Nifty CPSE, were done in multiple tranches, during the years 2017, 2018, 2019 and 2020.

The EPFO manages more than 300 million member accounts and has a corpus of ₹28 lakh crore.

You may also like

"It is highly condemnable": Karnataka Deputy CM D.K. Shivkumar on the alleged attempt to attack CJI B R Gavai inside the Supreme Court

Atlantic Unveils the Grand Prix Chronograph VBA Limited Edition – Tribute to Racing Excellence

North Korea's Kim holds talks with Laos president in Pyongyang

3 scientists win 2025 Chemistry Nobel for developing metal-organic frameworks

Woman orders ironing board on Temu but is gobsmacked when it turns up